Designing Banking Infrastructure

from Scratch

from Scratch

Designing Banking Infrastructure

from Scratch

from Scratch

Designed the full banking ecosystem from scratch: KYC-compliant onboarding, card issuing, SWIFT transfers, and operational tools for a regulated financial product — all as the solo designer.

Designed the full banking ecosystem from scratch: KYC-compliant onboarding, card issuing, SWIFT transfers, and operational tools for a regulated financial product — all as the solo designer.

INDUSTRY:

INDUSTRY:

FINTECH

FINTECH

YEAR:

YEAR:

2023

2023

EXPERIENCE:

EXPERIENCE:

PRODUCT DESIGN

PRODUCT DESIGN

01. Context

CFPS was building a digital bank for European users who needed simple, affordable international money management – competing with Revolut and Wise in a crowded market.

I joined at the pre-MVP stage as the sole product designer, responsible for the customer app, internal admin panel, and design system.

The goal: launch a fully compliant financial product in 10 months with a lean team and strict regulatory requirements.

CFPS was building a digital bank for European users who needed simple, affordable international money management – competing with Revolut and Wise in a crowded market.

I joined at the pre-MVP stage as the sole product designer, responsible for the customer app, internal admin panel, and design system.

The goal: launch a fully compliant financial product in 10 months with a lean team and strict regulatory requirements.

02. The challenge

CFPS needed to launch a fully regulated digital banking platform in 6 months with

a small team and no existing design foundations. As the sole designer, I faced four critical challenges:

Based on the research, I defined both problem and solution hypotheses. I assumed that users struggled to manage tariffs because there was no single interface and they depended on the backend team. Giving users the ability to add and manage data about clients, contracts, and tariff grids in one place — with a clear hierarchy and access restrictions – would reduce mistakes and make them fully autonomous.

Based on the research, I defined both problem and solution hypotheses. I assumed that users struggled to manage tariffs because there was no single interface and they depended on the backend team. Giving users the ability to add and manage data about clients, contracts, and tariff grids in one place — with a clear hierarchy and access restrictions – would reduce mistakes and make them fully autonomous.

[ 01 ]

Compliance-First Design

Designing for strict EU compliance (PSD2, KYC/AML) without sacrificing user experience. Every flow needed regulatory approval while feeling seamless.

[ 01 ]

Compliance-First Design

Designing for strict EU compliance (PSD2, KYC/AML) without sacrificing user experience. Every flow needed regulatory approval while feeling seamless.

[ 01 ]

Compliance-First Design

Designing for strict EU compliance (PSD2, KYC/AML) without sacrificing user experience. Every flow needed regulatory approval while feeling seamless.

[ 02 ]

Dual Product Scope

Building both customer-facing app and internal operations tools simultaneously – optimizing for simplicity and control at the same time.

[ 02 ]

Dual Product Scope

Building both customer-facing app and internal operations tools simultaneously – optimizing for simplicity and control at the same time.

[ 02 ]

Dual Product Scope

Building both customer-facing app and internal operations tools simultaneously – optimizing for simplicity and control at the same time.

[ 03 ]

Zero Foundation

Establishing a design system from scratch while shipping production features. No existing patterns, components, or guidelines to build on.

[ 03 ]

Zero Foundation

Establishing a design system from scratch while shipping production features. No existing patterns, components, or guidelines to build on.

[ 03 ]

Zero Foundation

Establishing a design system from scratch while shipping production features. No existing patterns, components, or guidelines to build on.

[ 04 ]

Building Trust

Creating trust with users who'd never heard of us, asking them to upload passports and link bank accounts to an unknown brand.

[ 04 ]

Building Trust

Creating trust with users who'd never heard of us, asking them to upload passports and link bank accounts to an unknown brand.

[ 04 ]

Building Trust

Creating trust with users who'd never heard of us, asking them to upload passports and link bank accounts to an unknown brand.

03. Research & Discovery

To understand our target users and validate our assumptions, I conducted 12

in-depth interviews with young professionals, freelancers, and students across Europe who frequently managed money internationally.

The interviews focused on understanding their current financial behavior, identifying pain points with existing banking solutions, and uncovering what builds trust in financial services. Key questions included:

– How do you currently manage finances across countries?

– What's most frustrating about your banking experience?

– What makes you trust a financial service with your money?

Based on the research, I defined both problem and solution hypotheses. I assumed that users struggled to manage tariffs because there was no single interface and they depended on the backend team. Giving users the ability to add and manage data about clients, contracts, and tariff grids in one place — with a clear hierarchy and access restrictions – would reduce mistakes and make them fully autonomous.

Based on the research, I defined both problem and solution hypotheses. I assumed that users struggled to manage tariffs because there was no single interface and they depended on the backend team. Giving users the ability to add and manage data about clients, contracts, and tariff grids in one place — with a clear hierarchy and access restrictions – would reduce mistakes and make them fully autonomous.

Opening my current bank account took three weeks. I had to visit a branch twice, submit paper documents, and wait for approval by mail. For a freelancer who just moved to a new country, that's impossible

Sofia Martínez

Freelance Graphic Designer

Opening my current bank account took three weeks. I had to visit a branch twice, submit paper documents, and wait for approval by mail. For a freelancer who just moved to a new country, that's impossible

Sofia Martínez

Freelance Graphic Designer

Opening my current bank account took three weeks. I had to visit a branch twice, submit paper documents, and wait for approval by mail. For a freelancer who just moved to a new country, that's impossible

Sofia Martínez

Freelance Graphic Designer

Every time I transfer money internationally, I check three different services to see who's lying less about fees. My bank says 'competitive rates' but then charges €15 and the exchange rate is terrible. I never know the real cost

James R

Software Engineer, Remote Worker

Every time I transfer money internationally, I check three different services to see who's lying less about fees. My bank says 'competitive rates' but then charges €15 and the exchange rate is terrible. I never know the real cost

James R

Software Engineer, Remote Worker

Every time I transfer money internationally, I check three different services to see who's lying less about fees. My bank says 'competitive rates' but then charges €15 and the exchange rate is terrible. I never know the real cost

James R

Software Engineer, Remote Worker

My bank's app rejected my passport photo three times with just 'Document unclear.' No explanation, no guidance on what's wrong. I felt like a criminal trying to verify my own identity. Eventually I gave up and went to a branch

Emma Jensen

Marketing Manager, Expat in Berlin

My bank's app rejected my passport photo three times with just 'Document unclear.' No explanation, no guidance on what's wrong. I felt like a criminal trying to verify my own identity. Eventually I gave up and went to a branch

Emma Jensen

Marketing Manager, Expat in Berlin

My bank's app rejected my passport photo three times with just 'Document unclear.' No explanation, no guidance on what's wrong. I felt like a criminal trying to verify my own identity. Eventually I gave up and went to a branch

Emma Jensen

Marketing Manager, Expat in Berlin

04. User Pain Points

Freelancers, students, and young professionals across Europe shared the same frustrations with traditional banks. Four problems emerged consistently.

Based on the research, I defined both problem and solution hypotheses. I assumed that users struggled to manage tariffs because there was no single interface and they depended on the backend team. Giving users the ability to add and manage data about clients, contracts, and tariff grids in one place — with a clear hierarchy and access restrictions – would reduce mistakes and make them fully autonomous.

Based on the research, I defined both problem and solution hypotheses. I assumed that users struggled to manage tariffs because there was no single interface and they depended on the backend team. Giving users the ability to add and manage data about clients, contracts, and tariff grids in one place — with a clear hierarchy and access restrictions – would reduce mistakes and make them fully autonomous.

[ 01 ]

Slow Account Opening

Branch visits, paper documents, and weeks of waiting made opening accounts impossible for mobile users.

[ 01 ]

Slow Account Opening

Branch visits, paper documents, and weeks of waiting made opening accounts impossible for mobile users.

[ 01 ]

Slow Account Opening

Branch visits, paper documents, and weeks of waiting made opening accounts impossible for mobile users.

[ 02 ]

Expensive & Hidden Fees

High fees and unclear exchange rates made international transfers unpredictable and costly.

[ 02 ]

Expensive & Hidden Fees

High fees and unclear exchange rates made international transfers unpredictable and costly.

[ 02 ]

Expensive & Hidden Fees

High fees and unclear exchange rates made international transfers unpredictable and costly.

[ 03 ]

Zero Spending Control

No real-time notifications, no instant card controls, no spending limits. Users had zero control over their money.

[ 03 ]

Zero Spending Control

No real-time notifications, no instant card controls, no spending limits. Users had zero control over their money.

[ 03 ]

Zero Spending Control

No real-time notifications, no instant card controls, no spending limits. Users had zero control over their money.

05. Competitive Analysis

I analyzed leading digital banks to understand what users expected from modern banking experiences and identify opportunities for differentiation.

Multi-currency accounts, cryptocurrency trading, stock investments, insurance products, business accounts, and travel perks.

International money transfers at mid-market rates, multi-currency account with 40+ currencies, debit card.

Free IBAN account with Mastercard, real-time spending notifications, instant transfers within SEPA zone, budget management tools.

05. Competitive Analysis

I analyzed leading digital banks to understand what users expected from modern banking experiences and identify opportunities for differentiation.

I analyzed leading digital banks to understand what users expected from modern banking experiences and identify opportunities for differentiation.

Multi-currency accounts, cryptocurrency trading, stock investments, insurance products, business accounts, and travel perks.

International money transfers at mid-market rates, multi-currency account with 40+ currencies, debit card.

Free IBAN account with Mastercard, real-time spending notifications, instant transfers within SEPA zone, budget management tools.

06. Problem Statement

⚡️

Users managing money internationally needed transparent pricing, instant account opening, and complete banking functionality in one place — but were forced into fragmented workflows across multiple platforms, unclear fee structures, and weeks-long onboarding processes that made digital banking feel as bureaucratic as traditional banks.

07. Defining the MVP

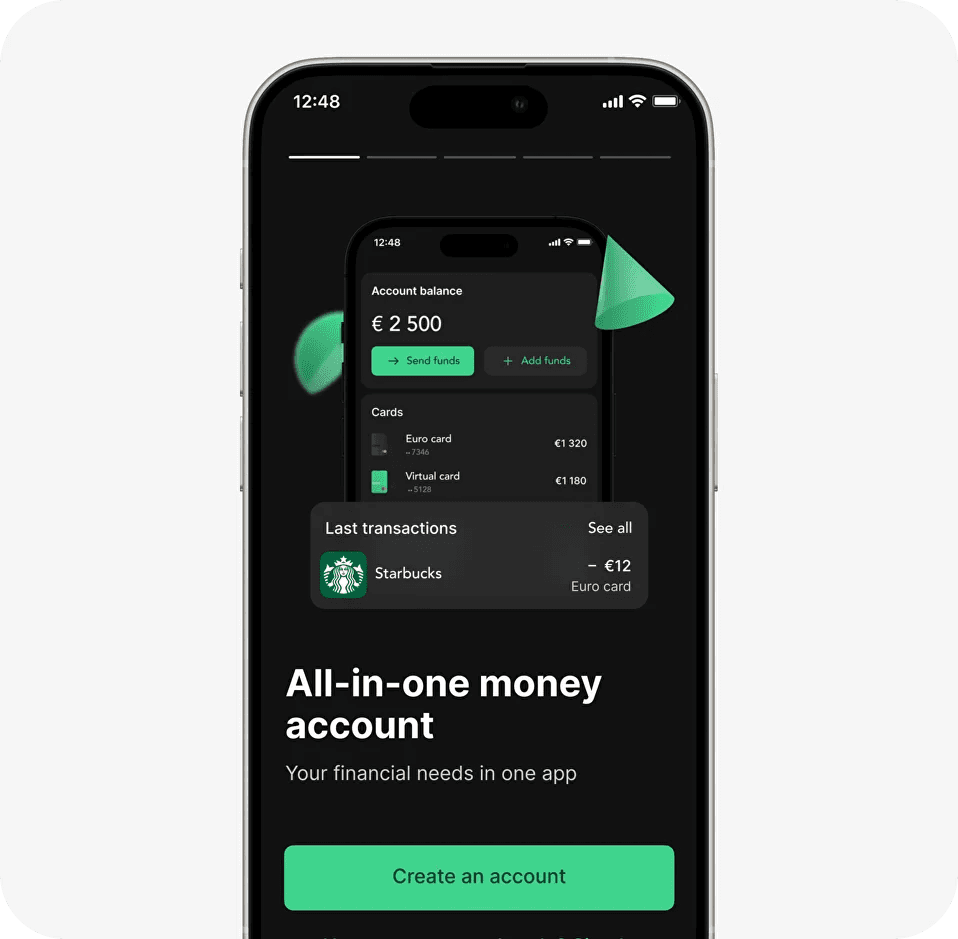

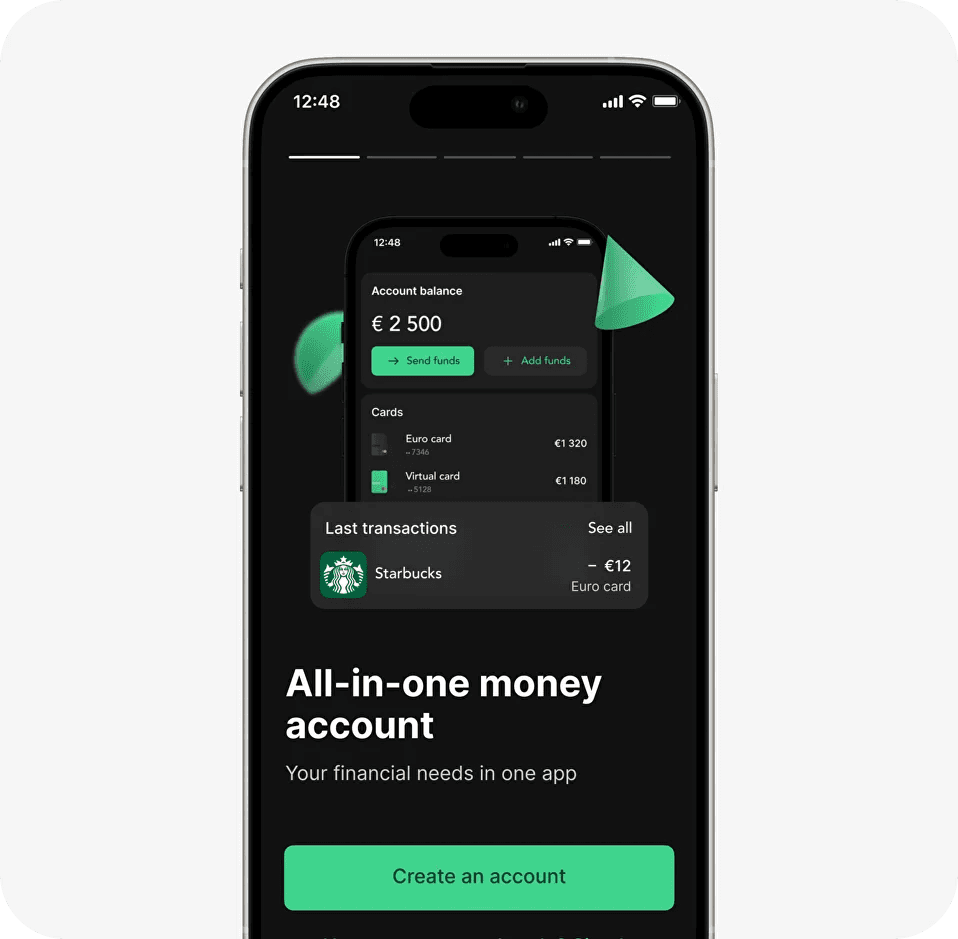

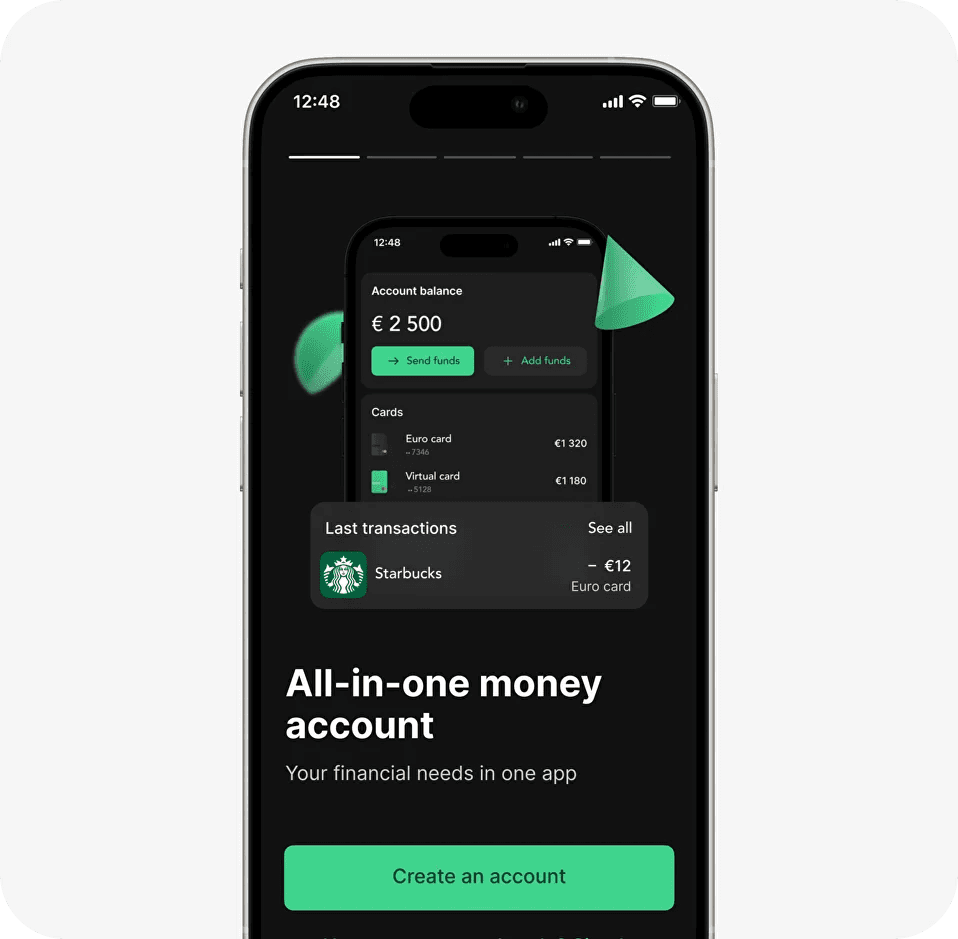

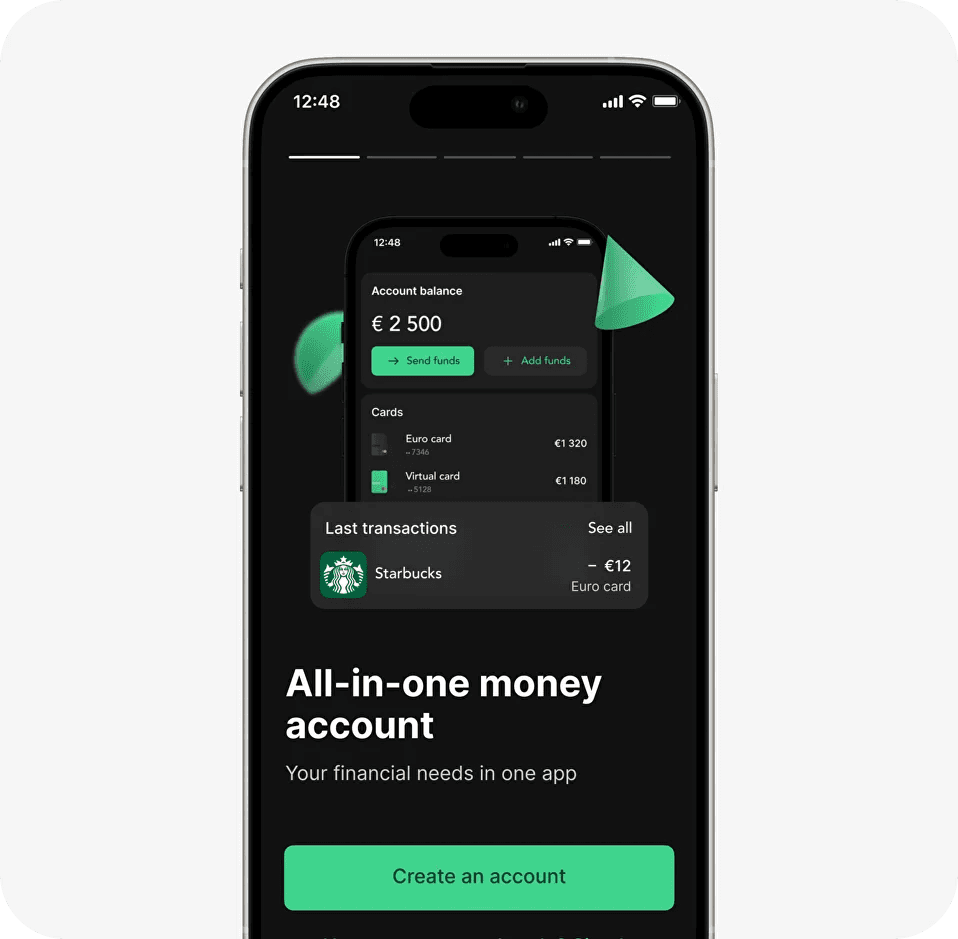

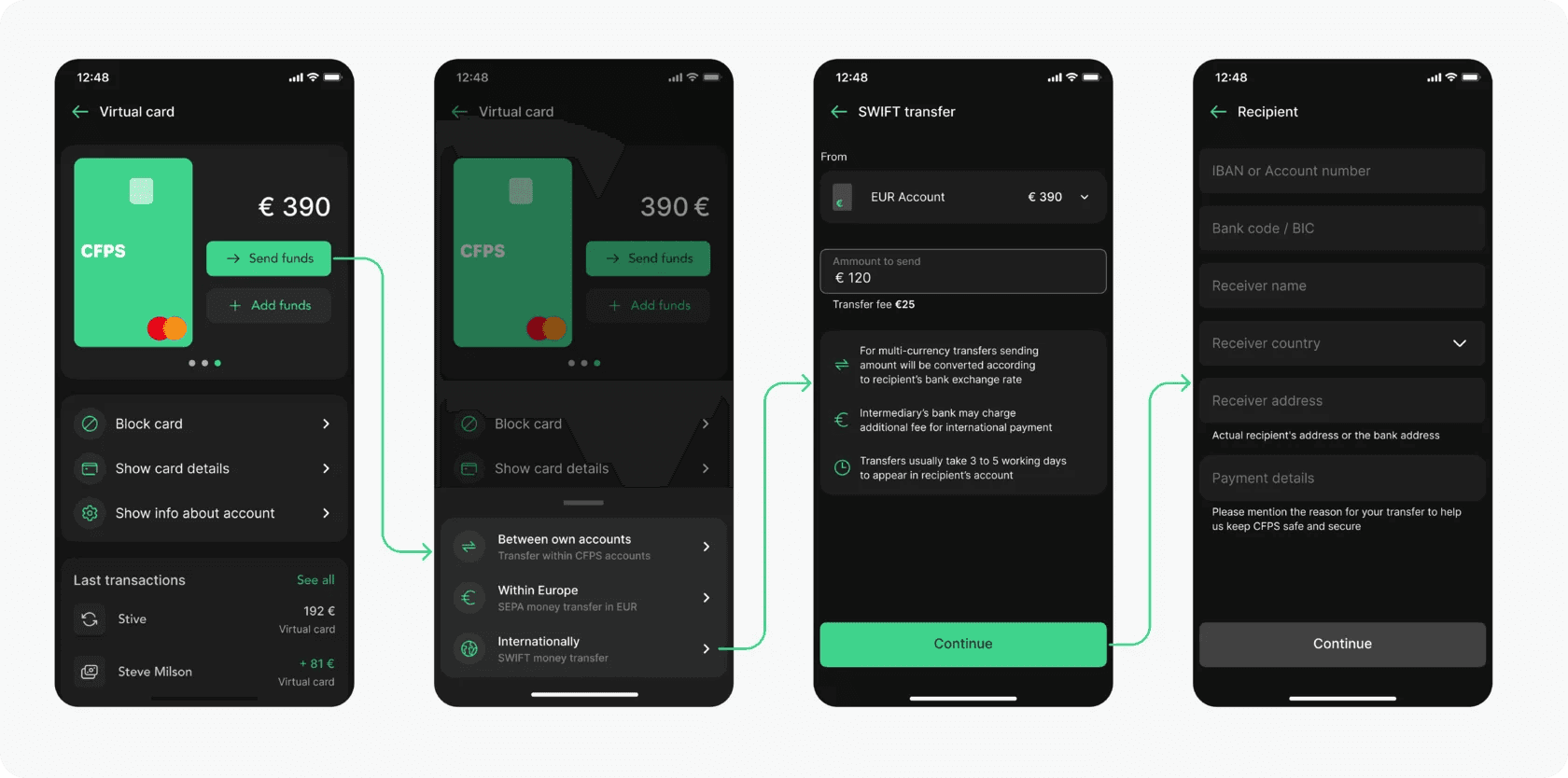

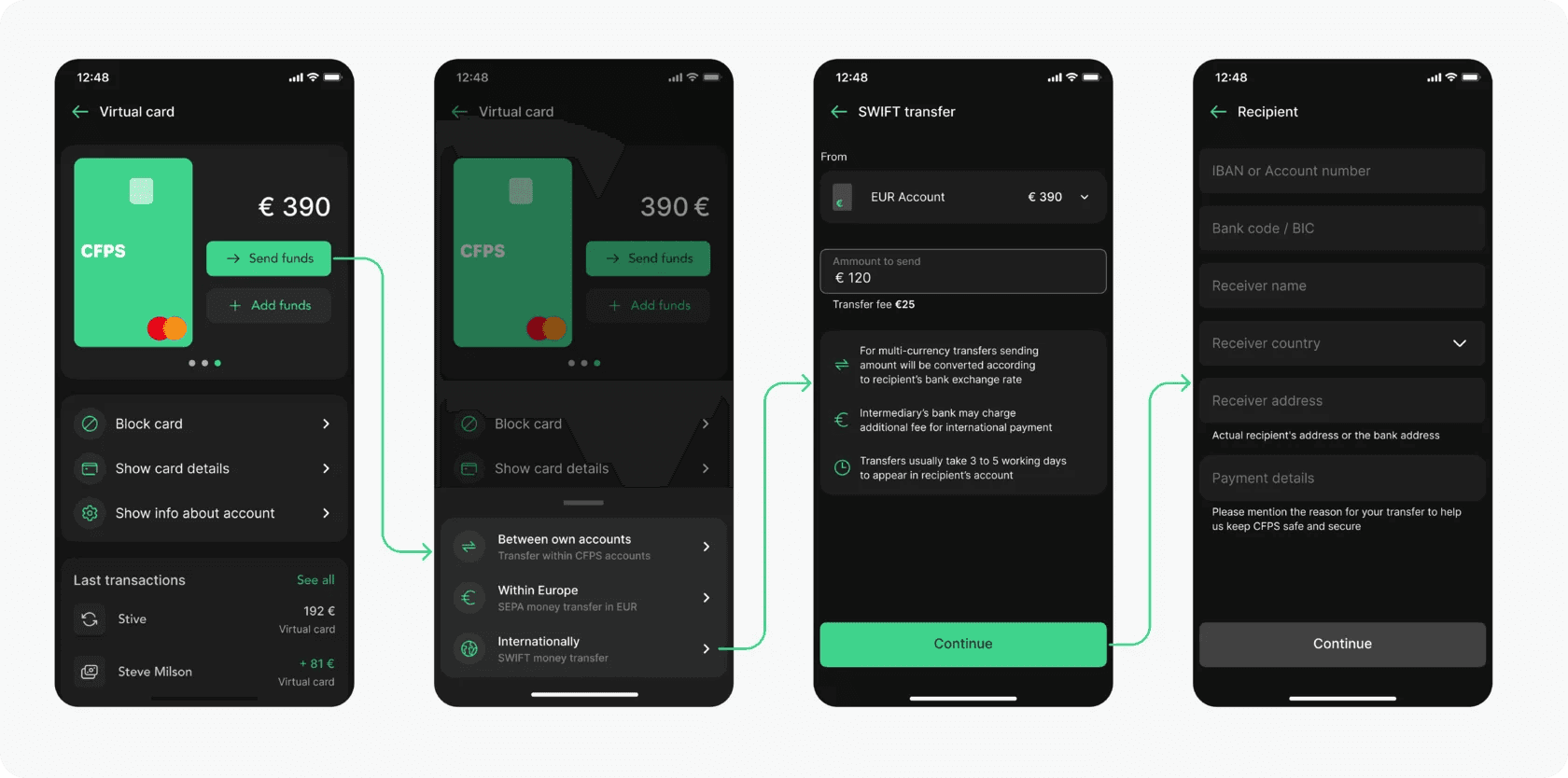

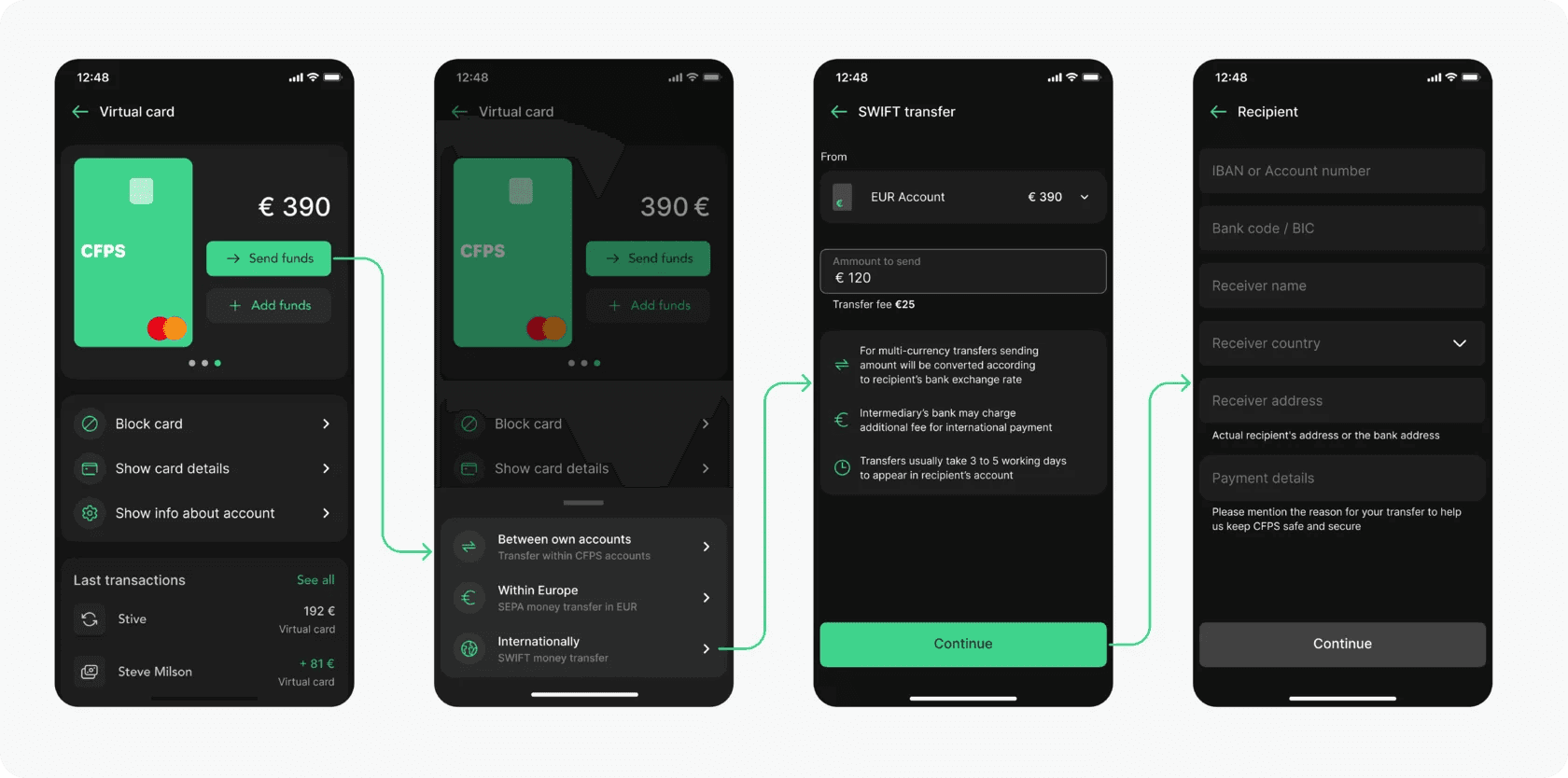

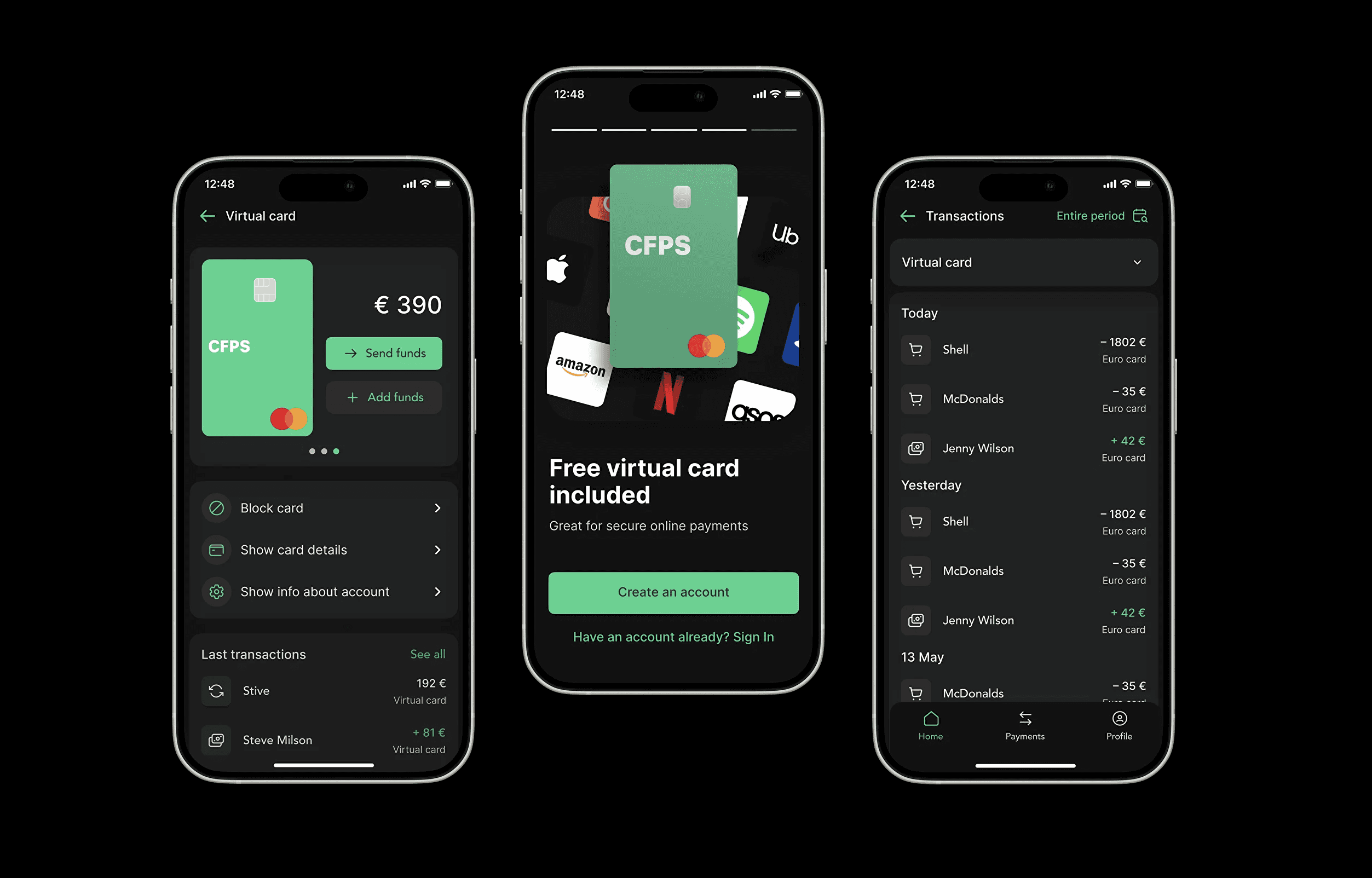

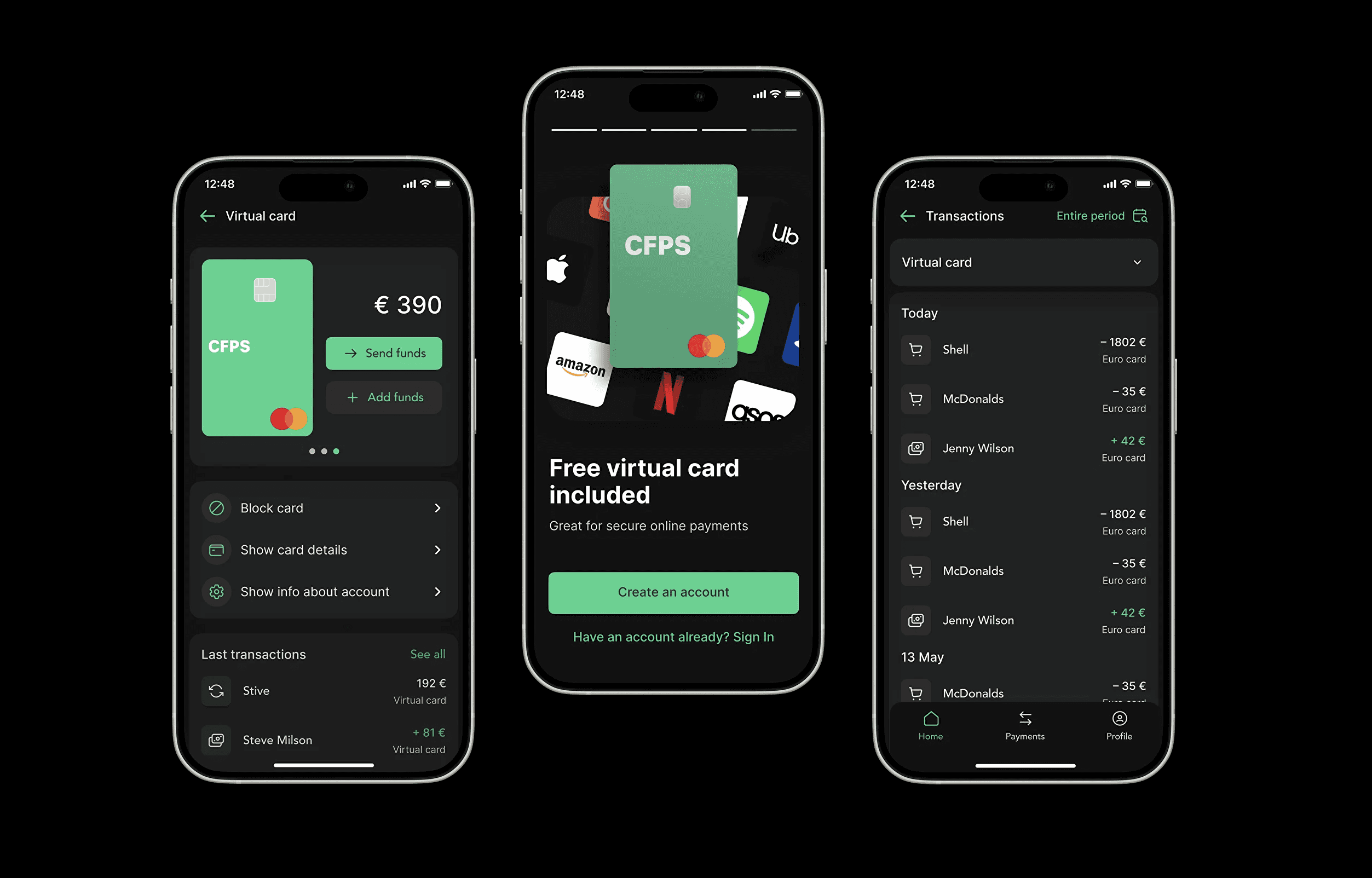

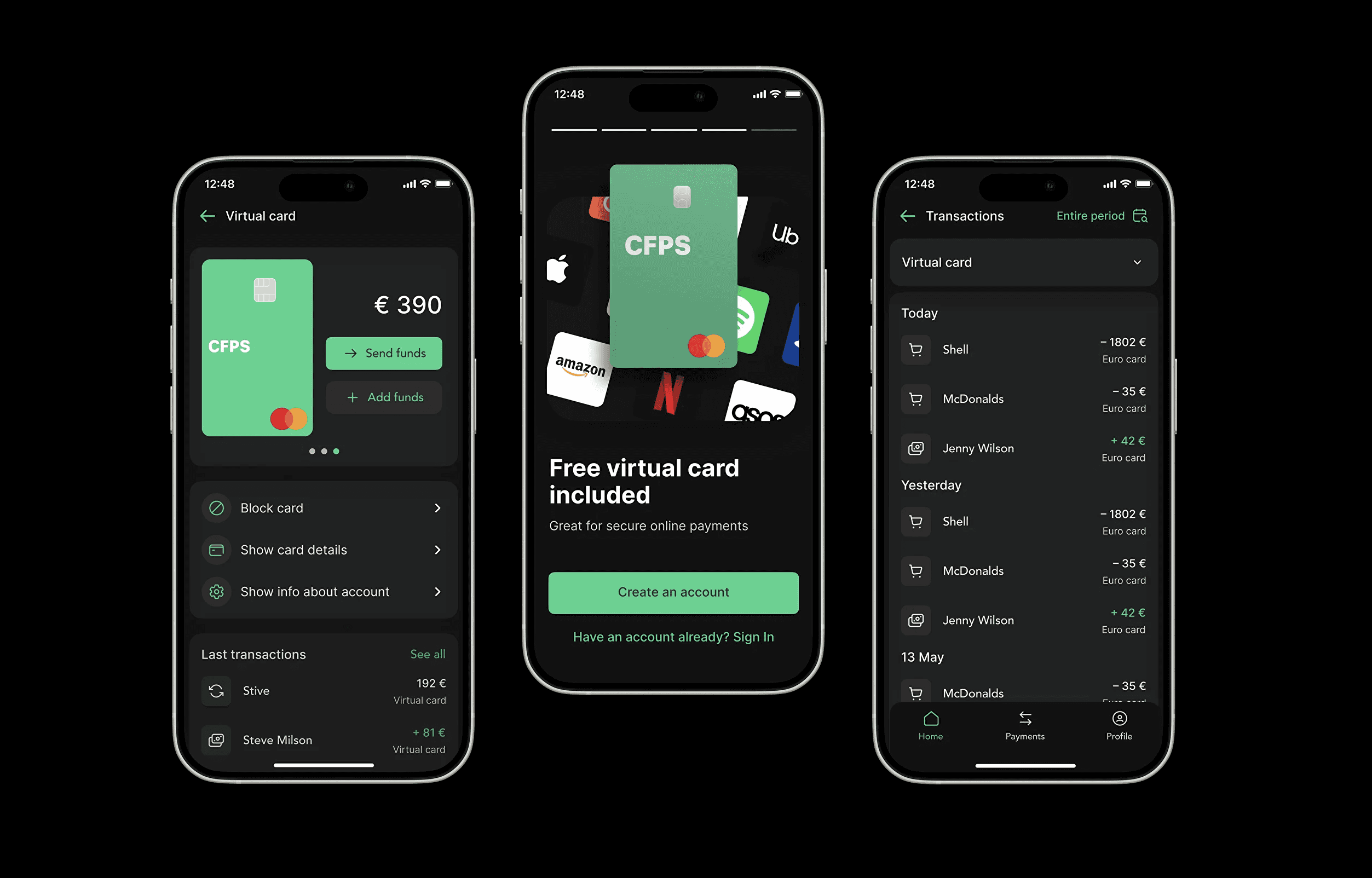

Based on research insights, I mapped critical user journeys and defined the MVP scope for the mobile app: essential banking functionality without feature bloat. Three flows needed to work flawlessly – account onboarding and KYC verification, money management and transfers, and card issuance with controls.

Based on the research, I defined both problem and solution hypotheses. I assumed that users struggled to manage tariffs because there was no single interface and they depended on the backend team. Giving users the ability to add and manage data about clients, contracts, and tariff grids in one place — with a clear hierarchy and access restrictions – would reduce mistakes and make them fully autonomous.

Based on the research, I defined both problem and solution hypotheses. I assumed that users struggled to manage tariffs because there was no single interface and they depended on the backend team. Giving users the ability to add and manage data about clients, contracts, and tariff grids in one place — with a clear hierarchy and access restrictions – would reduce mistakes and make them fully autonomous.

→

Onboarding & Verification

Onboarding & Verification

→

Account Dashboard

Account Dashboard

→

Card Management

Card Management

→

Payments & Transfers

Payments & Transfers

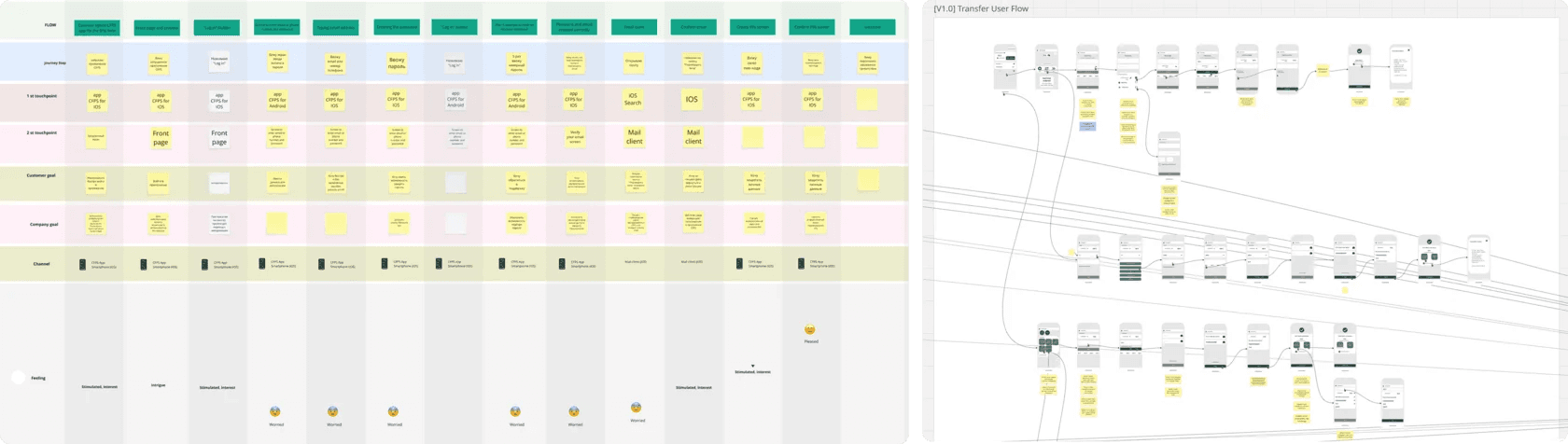

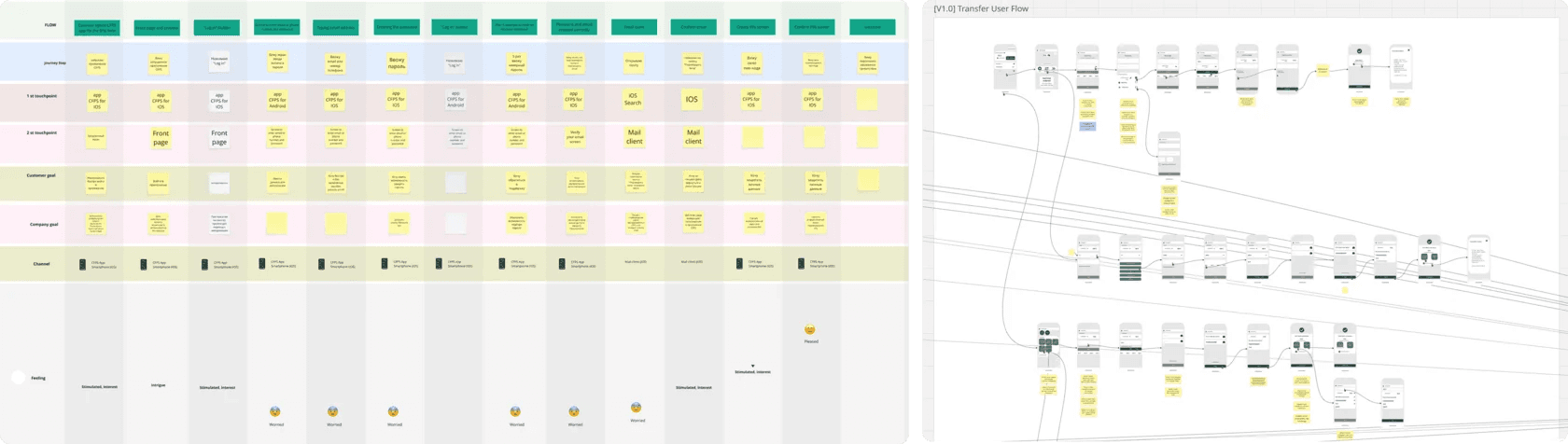

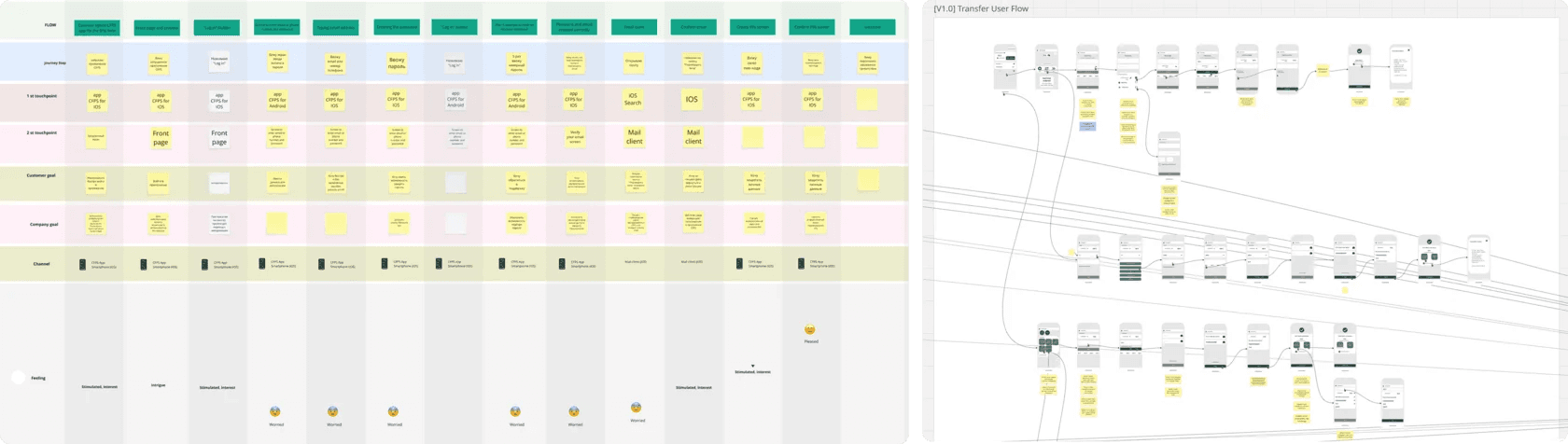

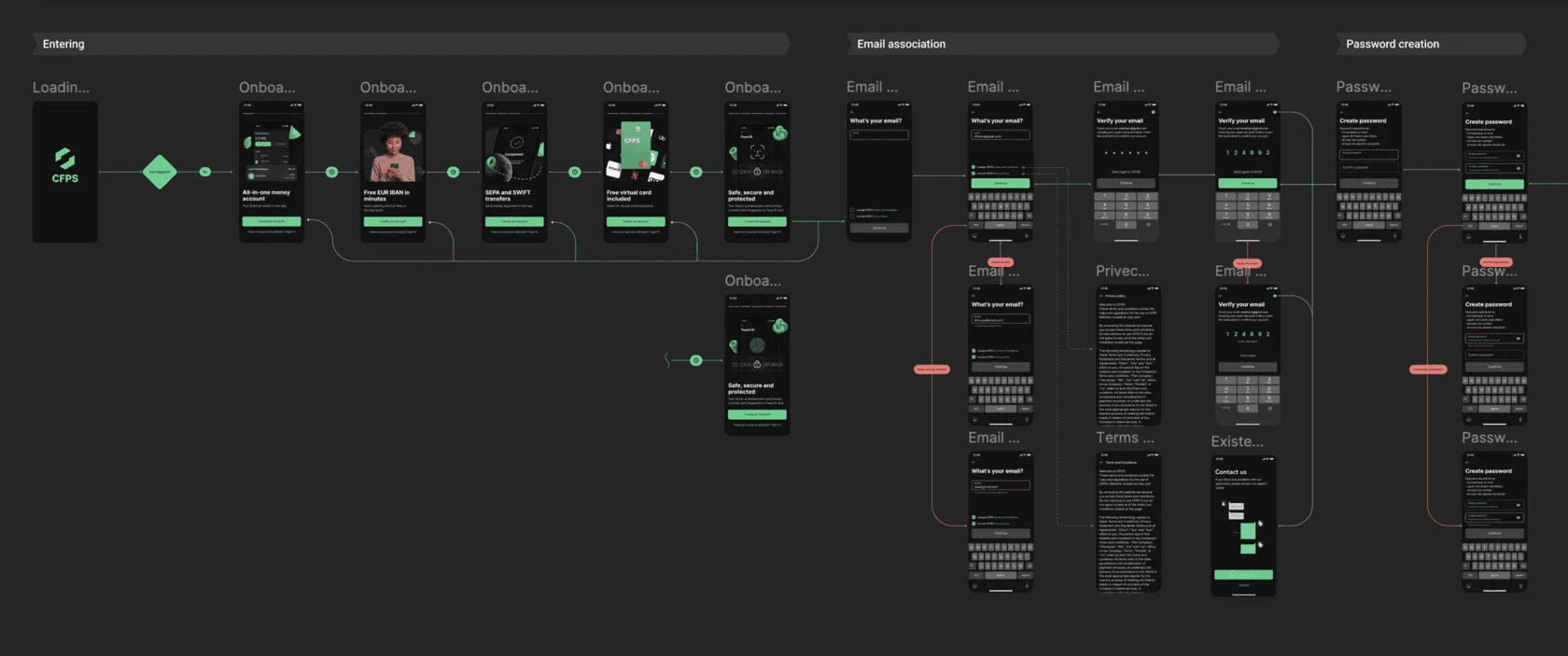

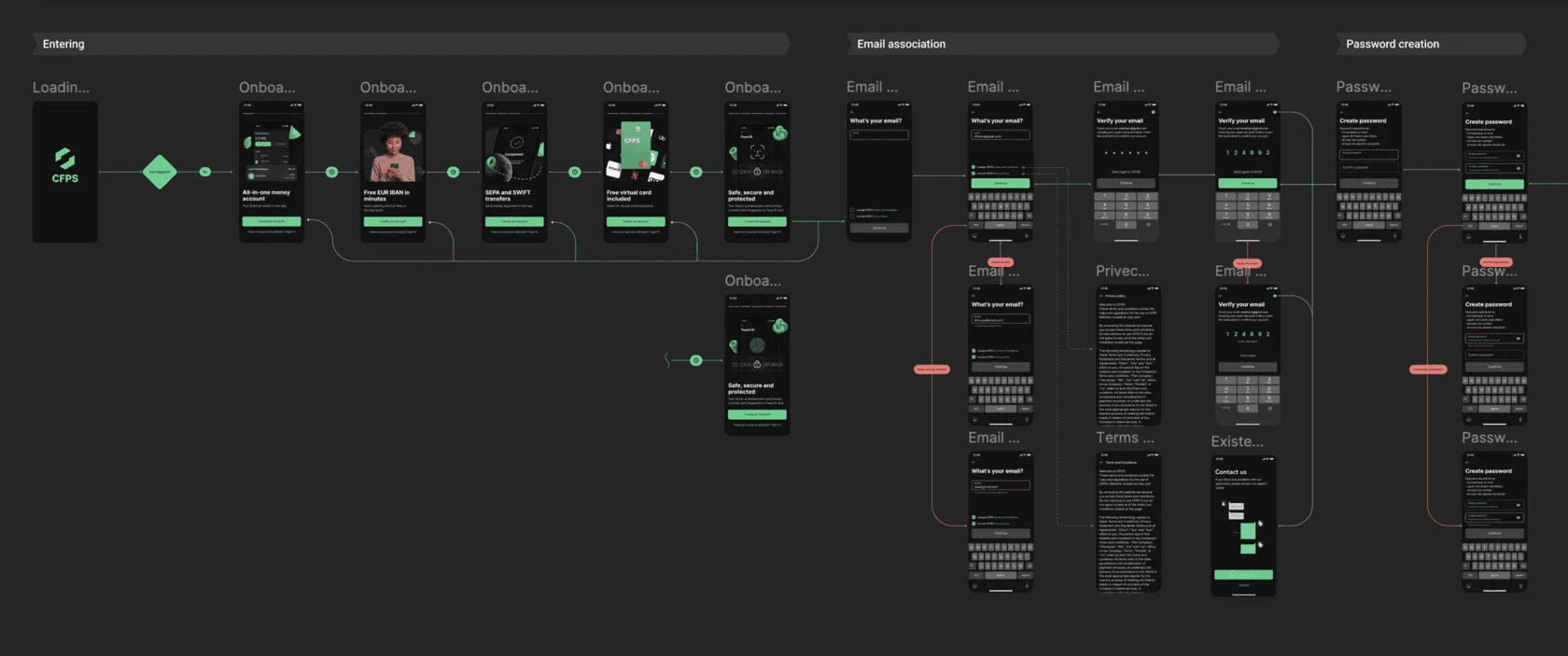

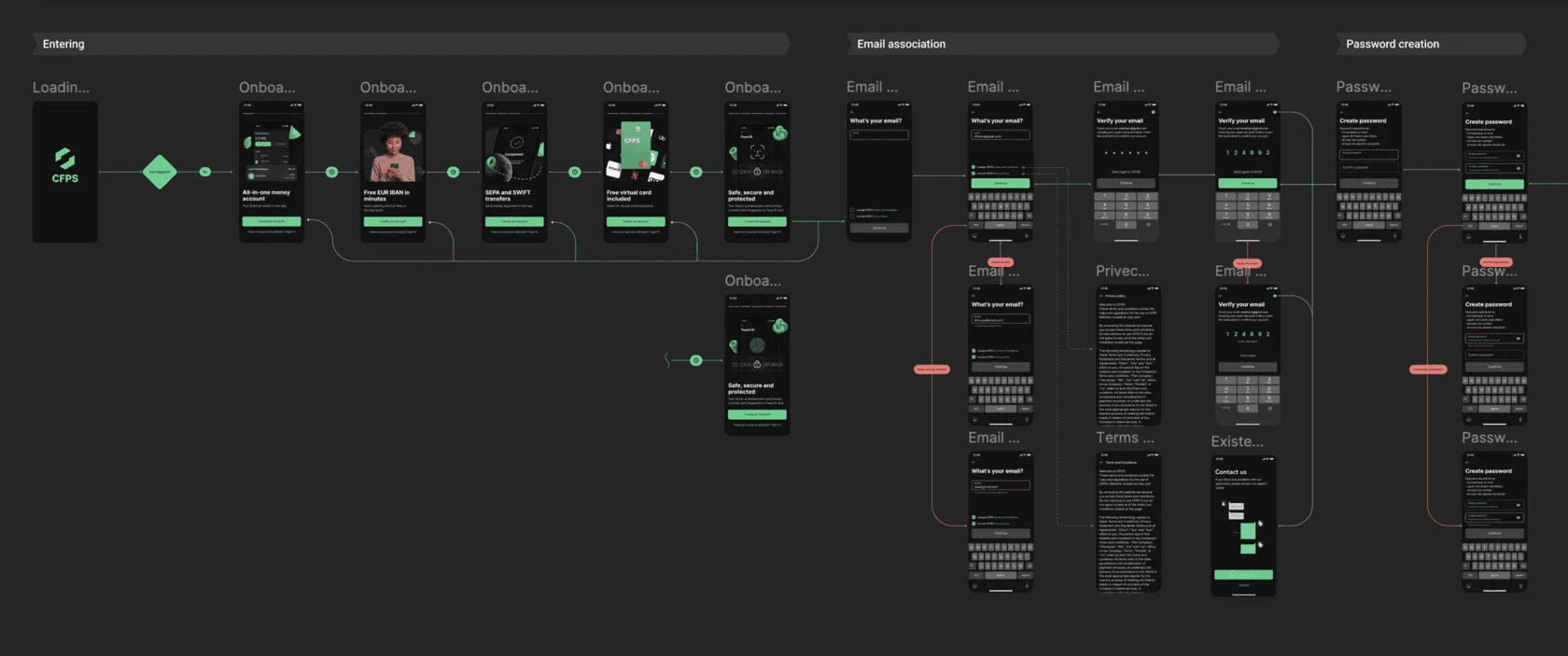

08. User Flows & Wireframes

08. User Flows

& Wireframes

& Wireframes

I mapped detailed user flows for critical features — account registration, KYC verification, card issuance, transfers, and transaction management — identifying decision points, error states, and regulatory requirements at each step.

Low-fidelity wireframes validated these flows with the team, testing navigation patterns and compliance requirements before high-fidelity design. This helped catch regulatory and technical constraints early, reducing costly iterations later.

Based on the research, I defined both problem and solution hypotheses. I assumed that users struggled to manage tariffs because there was no single interface and they depended on the backend team. Giving users the ability to add and manage data about clients, contracts, and tariff grids in one place — with a clear hierarchy and access restrictions – would reduce mistakes and make them fully autonomous.

Based on the research, I defined both problem and solution hypotheses. I assumed that users struggled to manage tariffs because there was no single interface and they depended on the backend team. Giving users the ability to add and manage data about clients, contracts, and tariff grids in one place — with a clear hierarchy and access restrictions – would reduce mistakes and make them fully autonomous.

09. Low-Fidelity Testing & Iteration

09. Low-Fidelity Testing

& Iteration

I tested low-fidelity prototypes with 8 potential users to validate core flows and identify critical usability issues before investing in high-fidelity design. Testing 31 hypotheses across key features revealed 9 critical issues that would have caused significant drop-off in production, while validating 21 hypotheses and identifying 11 areas requiring iteration.

Based on the research, I defined both problem and solution hypotheses. I assumed that users struggled to manage tariffs because there was no single interface and they depended on the backend team. Giving users the ability to add and manage data about clients, contracts, and tariff grids in one place — with a clear hierarchy and access restrictions – would reduce mistakes and make them fully autonomous.

Based on the research, I defined both problem and solution hypotheses. I assumed that users struggled to manage tariffs because there was no single interface and they depended on the backend team. Giving users the ability to add and manage data about clients, contracts, and tariff grids in one place — with a clear hierarchy and access restrictions – would reduce mistakes and make them fully autonomous.

[ 01 ]

Design Issues

6 problems (3 high, 3 medium) – document upload requirements needed clarification, KYC progress wasn't visible, card control layout confused users.

[ 01 ]

Design Issues

6 problems (3 high, 3 medium) – document upload requirements needed clarification, KYC progress wasn't visible, card control layout confused users.

[ 01 ]

Design Issues

6 problems (3 high, 3 medium) – document upload requirements needed clarification, KYC progress wasn't visible, card control layout confused users.

[ 02 ]

Content & Copy

7 problems (3 high, 2 medium, 2 low) – card terms and conditions weren't clear, delivery tracking status caused confusion, fee structure needed better explanation.

[ 02 ]

Content & Copy

7 problems (3 high, 2 medium, 2 low) – card terms and conditions weren't clear, delivery tracking status caused confusion, fee structure needed better explanation.

[ 02 ]

Content & Copy

7 problems (3 high, 2 medium, 2 low) – card terms and conditions weren't clear, delivery tracking status caused confusion, fee structure needed better explanation.

[ 03 ]

Navigation

1 problem (medium) – users couldn't locate key actions during account setup and card management.

[ 03 ]

Navigation

1 problem (medium) – users couldn't locate key actions during account setup and card management.

[ 03 ]

Navigation

1 problem (medium) – users couldn't locate key actions during account setup and card management.

10. Design system

Main scenarios were clear, wireframes were ready and approved, so I started building the first version.

I began with the design system: created base components, color, typography, and grid guides.

Main scenarios were clear, wireframes were ready and approved, so I started building the first version.

I began with the design system: created base components, color, typography, and grid guides.

11. Components

I added atoms – buttons, icons, and input fields – then progressed to molecules like forms, navigation menus, notifications, and card layouts that combined these foundational elements into reusable patterns.

I added atoms – buttons, icons, and input fields – then progressed to molecules like forms, navigation menus, notifications, and card layouts that combined these foundational elements into reusable patterns.

12. High-Fidelity Design

High-fidelity design was built in phases: onboarding and KYC first, then dashboard and card management, followed by transaction history, transfers, and SWIFT payments. Each iteration added critical functionality while maintaining consistency through the design system.

High-fidelity design was built in phases: onboarding and KYC first, then dashboard and card management, followed by transaction history, transfers, and SWIFT payments. Each iteration added critical functionality while maintaining consistency through the design system.

13. Result

I built the foundation for the admin panel design. Screens could now be built faster and stay visually consistent.

Developers and designers would be able to create interfaces without duplicating solutions.

Based on the research, I defined both problem and solution hypotheses. I assumed that users struggled to manage tariffs because there was no single interface and they depended on the backend team. Giving users the ability to add and manage data about clients, contracts, and tariff grids in one place — with a clear hierarchy and access restrictions – would reduce mistakes and make them fully autonomous.

Based on the research, I defined both problem and solution hypotheses. I assumed that users struggled to manage tariffs because there was no single interface and they depended on the backend team. Giving users the ability to add and manage data about clients, contracts, and tariff grids in one place — with a clear hierarchy and access restrictions – would reduce mistakes and make them fully autonomous.

[ Results ]

[ Results ]

[ Results ]

Key Results & Impact

0+

0+

[ APP DOWNLOADS ]

0+

0+

[ CARDS ISSUED ]

0%

0%

[ KYC COMPLETION RATE ]

0

0

[ MONTHS TO LAUNCH ]